This is an exercise I perform with my boards no less than once every several years in planning exercises attended by the board and senior management, sometimes augmented with an industry consultant or expert from the outside.

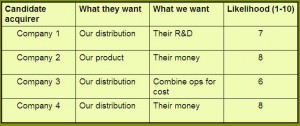

Use a white board visible to the entire group. Draw and label four columns and ten rows. The columns: “Name of candidate acquirer”, “what they want”, “what we want” and “likelihood”.  Then in a brainstorming session, fill in the ten rows with the names of ten potential purchasers of the business, looking deeply for strategic and emotional candidates (see insight 91). Next, return to the list on the board and have the group do its best to divine what it is about your company that would most attract the buyer if it had perfect knowledge of your business and its resources. This could be your intellectual property, your geographic reach, your superior product, your management team, or perhaps your dominant position. Next, have the group focus upon column three, ignoring the obvious gain our company would make in liquidity to shareholders. List what the company would most gain in new resources from this acquirer. Would it be more cash for expansion, new intellectual property, better distribution, completion of drug trials, or more? And finally, have the group put a number in column four, estimating the likelihood of such a sale ever being consummated, with “10” the absolute highest and “1” unlikely to occur.

Then in a brainstorming session, fill in the ten rows with the names of ten potential purchasers of the business, looking deeply for strategic and emotional candidates (see insight 91). Next, return to the list on the board and have the group do its best to divine what it is about your company that would most attract the buyer if it had perfect knowledge of your business and its resources. This could be your intellectual property, your geographic reach, your superior product, your management team, or perhaps your dominant position. Next, have the group focus upon column three, ignoring the obvious gain our company would make in liquidity to shareholders. List what the company would most gain in new resources from this acquirer. Would it be more cash for expansion, new intellectual property, better distribution, completion of drug trials, or more? And finally, have the group put a number in column four, estimating the likelihood of such a sale ever being consummated, with “10” the absolute highest and “1” unlikely to occur.

[Email readers continue here…] The magic of this exercise is not only in the organization of group focus upon the liquidity event and possible buyers. It is in revisiting column two of the chart. You will quickly note that at least four of the ten candidates, if each had perfect knowledge of your company and its resources, would want the very same thing from an acquisition. Whatever that is, it shines as the true core competency of your corporation, whether previously expressed or even recognized by management. It is in this area where I would redirect resources such as manpower and money, to build value more effectively and quickly than in any other area of the enterprise.

Occasionally, the insight gained from this exercise comes as a complete surprise to the board and management. And that is most rewarding to see.

Incredible powerful. If companies were build focusing their efforts on building value for their future potential buyers…they would build value indeed. Thanks Dave.

Dave,

This was incredibly helpful…as are all of your posts!

Thank you.